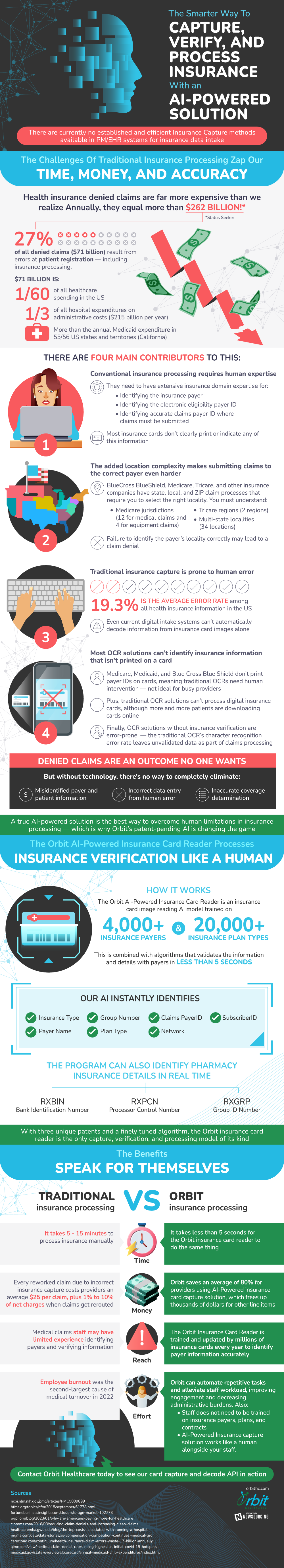

The U.S healthcare system has been a subject of harsh criticism for awhile. While many of these critiques are contentious, there’s one issue that everyone should be onboard with improving. Efficiency. Currently 27% of insurance claim denials result from simple patient registration and processing error.

These errors are losing insurance companies and consumers alike money. Every time a claim is reworked the company will pay fees and lose money on the reroute. Every time a claim stays denied consumers lose out on money that they deserved. Naturally then it’s in everyone’s best interest to start reducing these errors.

At first glance this seems really challenging. The majority of these errors are due to simple human mistakes. People submit claims to the wrong place and with the wrong information constantly. Although there is a solution. Card readers, taking in people’s insurance information for them, have become popular as of late.

This new bit of technology is great. It makes things easier, reduces error, and speeds things up. Although the next advancement is even more exciting. AI powered card readers are now entering the market. These new and more advanced card readers don’t just recognize text, but are trained on insurance information specifically. This makes them quicker, more accurate, and more efficient.

The other big advantage of AI powered insurance card capture is that they can capture, recognize, and verify information all at once. Typically this is a multi step process that may involve human verification. Although because these readers are trained on insurance cards specifically, humans can be removed from the equation. What this means is that, again, everyone is better off. Providers and individuals submitting claims alike are saving money.

Source: OrbitHC